As we move into 2025, the latest Q4 2024 Civil Construction Market Confidence Poll reveals a notable increase in optimism across the industry. The survey, conducted among construction professionals on LinkedIn, provides valuable insight into how the sector is adapting to economic and political shifts.

Q4 2024 Market Confidence Results

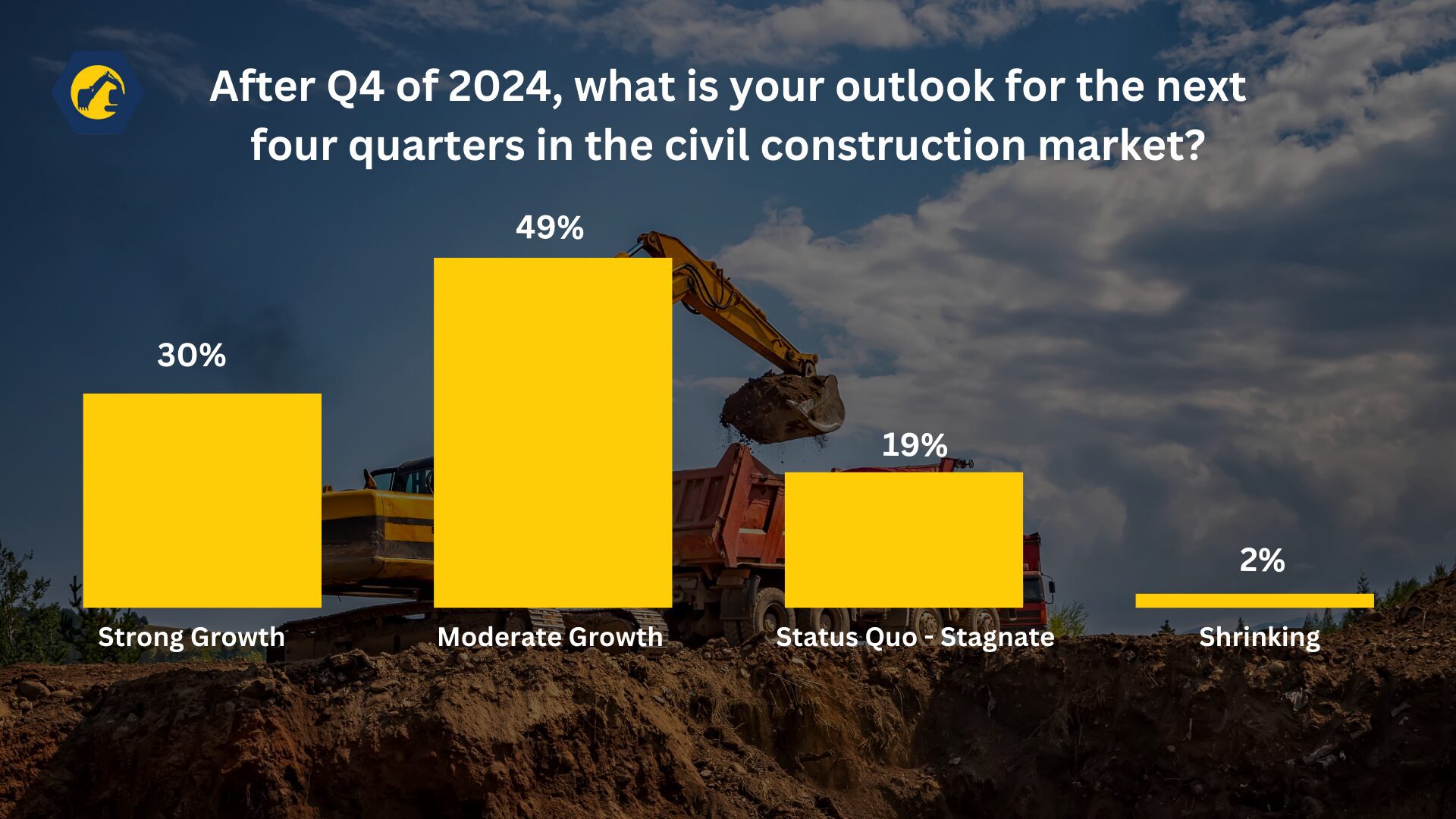

The Q4 poll results show a significant improvement in industry sentiment compared to the previous quarter. Here’s how construction professionals responded when asked about their outlook for the next four quarters:

- 30% predict strong growth

- 49% expect moderate growth

- 19% anticipate market stagnation

- Only 2% foresee contraction

This marks a substantial shift, with 79% of respondents now expecting some form of growth, compared to just 56% in Q3. The decrease in pessimism is equally striking—only 21% of professionals now anticipate stagnation or decline, compared to 44% in the previous quarter.

Comparing Q4 2024 vs. Q3 2024: What’s Changed?

At the end of Q3 2024, the industry was showing growing caution amid economic uncertainties. Rising material costs, labor shortages, and concerns surrounding the presidential election had many professionals taking a more conservative stance on future growth.

Now, just one quarter later, confidence has rebounded. Here’s a breakdown of the key differences between Q4 and Q3:

- 30% predict strong growth (up from 22% in Q3)

- 49% expect moderate growth (up from 34% in Q3)

- 19% anticipate market stagnation (down from 32% in Q3)

- Only 2% foresee contraction (down from 12% in Q3)

This marks a substantial shift, with 79% of respondents now expecting some form of growth, compared to just 56% in Q3. The decrease in pessimism is equally striking—only 21% of professionals now anticipate stagnation or decline, compared to 44% in the previous quarter.

The numbers tell a clear story of increasing optimism heading into 2025. But what’s driving this shift?

Key Factors Fueling the Market’s Confidence

1️⃣ Post-Election Stability – With the uncertainty of the election behind us and a familiar administration returning to office, many professionals are confident that infrastructure investment will remain a priority.

2️⃣ Regulatory Changes & Policy Expectations – The expectation that President Trump’s administration will reduce regulations and streamline government oversight on construction projects has increased confidence in long-term project stability.

3️⃣ Material Cost Stabilization – After years of instability, material costs are showing signs of stabilization, and regional supply chains are recovering, making project budgets more predictable.

4️⃣ Proactive Hiring & Workforce Development – While labor shortages remain a challenge, many firms are taking strategic steps to attract and retain talent, turning this obstacle into an opportunity for growth.

What This Means for the Industry in 2025

With nearly 80% of construction professionals expecting growth, the focus in 2025 will be on capitalizing on new opportunities. Here are three key takeaways:

✅ Watch for new infrastructure projects – Federal investment plans will play a critical role in shaping market demand. Stay engaged with funding developments in your region.

✅ Adaptability will be key – Firms that are prepared to scale hiring, adjust budgets, and embrace new technologies will have a competitive advantage.

✅ Stay informed on policy changes – The new administration’s policies will impact everything from project approvals to material costs, so tracking legislative updates is crucial.

Final Thoughts

The Q4 2024 Civil Construction Market Confidence Poll shows a strong resurgence in optimism, with nearly 80% of professionals anticipating growth—a significant increase from just a quarter ago. With economic stabilization, expected policy shifts, and renewed infrastructure investments, 2025 is shaping up to be a pivotal year for the industry.